本週Fed還會再Cut rate 幾近確定,但是幅度呢?

一般預期在25到50bps,不管如何,加上上星期的緊急降息,本月份至少降1%,

降息最快的效果來自於信心,

要有實質的影響,一般是lag 3~9個月,而且遞沿時間也不穩定

金融業的問題,還是需要時間來調整

本周經濟焦點》降息或助美國經濟暫渡難關,但銀行業困境難以迅速改觀

路透華盛頓1月27日電---若本周美國聯邦儲備理事會(美聯儲,FED)再次降息,將會幫助信用良好的借款人保住房屋按揭貸款或者商業貸款,同時為搖搖欲墜的全球金融系統提供支撐.

美聯儲料將於周三至少將指標聯邦基金利率目標調降0.25個百分點,就在利率決定公布的八天之前該央行剛剛緊急降息75個基點.這是聯儲有史以來最為迅速的一次減息行動,旨在振奮低迷的美國經濟.

不過單憑聯儲降息的行動無法徹底扭轉美國經濟放緩,甚至滑向衰退的局面;而且這也不能說明近幾年來幫助樓市和企業獲利穩定在高峰的寬鬆貨幣政策環境再度來臨.貨幣政策並不能快速解決這些極大的宏觀經濟問題.

"美聯儲所能起到的不過是緩和的作用,但無論如何經濟都將遭受重創."Harris私人銀行投資長Jack Ablin表示.

不過,有跡象表明聯儲降息這一劑猛藥已開始對房屋貸款市場這一重要經濟領域發揮作用.近期的降息舉措,以及對進一步放寬政策的預期,在上周將30年期固息抵押貸款利率推至近四年低點,並且刺激再融資申請數量大增16.9%.

該舉措還可能有助解決上萬億美元可調整利率抵押貸款今年重新確定條款的問題.市場對此最大的顧慮是,此類貸款的利率將會上浮,從而加重借款人的月供負擔,導致出現更多違約事件.

**銀行業短期內難以翻身**

無論降息幅度有多大,都無法使不良貸款變成優質資產,因此即便美聯儲的種種努力可能會幫到房主和消費者,但要看到銀行業獲利改善恐怕還要假以時日.

目前銀行業的問題可以追溯到本世紀初的無節制放貸時期.當時許多抵押貸款經紀商急於向購房者發放貸款,根本不問後者有無收入證明或還款能力,因他們認為房價將繼續快速上漲,即便購房者還款時感到吃力也能通過日後再融資加以解決.聯儲主席貝南克將之稱為"有瑕疵的假設".危機爆發以後,次優抵押貸款市場被斷然關閉,無論本輪降息周期內利率將降至何種程度,該市場都暫時不大可能重新開放.

各大銀行的財務狀況被這種以有瑕疵的假設為前提而放出的抵押貸款弄得一團糟,現在信用卡和汽車貸款等其他消費信貸領域也被拖下水.全美最大的獨立信用卡發行商Capital One

標準普爾的母公司McGraw-Hill Cos

研究機構Dealogic的數據顯示,在信貸疑慮的打擊下,併購活動也明顯放慢.今年迄今全球範圍內達成的併購交易規模總計達1,172億美元,較上年同期下降16%.在美國只達成339億美元的併購交易,同比大降40%.

曾任美聯儲經濟學家,現為芝加哥大學商學院經濟學教授的Anil Kashyap認為,降息是穩定金融系統的"間接途徑"."如果銀行需要資本,這種方式起效太慢.(降息)只是加大了長短期債務的收益之差,最終提升銀行的獲利."他說.

但與此同時,經濟各領域的發展卻因缺乏投資而受阻.美聯儲前主席格林斯潘上周表示,美國正處於--甚至已經越過了--衰退邊緣,應和了此前預期經濟衰退的眾多經濟學家的觀點.

聯儲上周降息時已經承認,隨著全球股市重挫,以及美國經濟數據顯示12月就業市場、零售銷售和製造業均下滑,降息時機至為重要.

聯邦公開市場委員會(FOMC)周三將必須作出利率決定,而屆時不會有表明經濟疲勢是否延續到了新一年的明確圖景.最早的一項重要數據,即1月非農就業報告要到周五才會出爐.Kashyap指出,若1月報告與12月同樣糟糕,將有可能再次動搖投資者信心,而美聯儲也可能被迫考慮再一次緊急降息.(完)

--翻譯 徐文焰;審校 白雲

2008年1月28日 星期一

[經濟分析摘要]降息或助美國經濟暫渡難關,但銀行業困境難以迅速改觀 20080128

[每日摘要]20080128

市場維持一貫的Choppy,預計本週應該也是同樣的局面,

沒有固定的走勢,就代表了場內交易員是處在一個沒有View的情勢下去追價

將眼界放短,不求太多獲利,但求無傷。

通常這種局面不會維持太久,但是一有變化往往會很激烈。

新興市場貨幣還是弱勢,尤其是KRW,近期飽受股市不振及外資流出的賣壓不斷

又再一次測試950。只有人民幣是反其它人之道而行,仍是升升不息

農曆年前的匯回令人民幣再破紀錄

但是台幣今年出口商的匯回就不若以往強烈,

還是在32.2~32.4中間遊走。

高盛一篇報告指出日本已經陷入衰退,部份來自出口趨軟及消費不振

衰退機率近60%,但是日元今日還是升值。大多數原因來自於美金轉強,而不是日元偏好。

1. UK's Blancflower says something

RTRS-RPT-BoE's Blanchflower says UK rates "restrictive"

LONDON, Jan 28 (Reuters) - The Bank of England needs to stop

worrying about inflation and cut interest rates to prevent a

sharp slowdown in growth, central bank policymaker David

Blanchflower said in an interview published on Monday.

In an interview with the Guardian newspaper, Blanchflower

said it was essential the Bank of England's Monetary Policy

Committee (MPC) "get ahead of the curve" as the current level of

UK interest rates at 5.5 percent was "restrictive."

"Worrying about inflation at this time seems like fiddling

when Rome burns," said Blanchflower, the only MPC member to vote

for a rate cut earlier this month.

The other eight policymakers favoured leaving borrowing

costs at 5.5 percent because of upside risks to inflation.

MPC member Andrew Sentance told Reuters last week that

market expectations of several more rate cuts were ignoring

rising price pressures.

Central bank Governor Mervyn King also said last week that

policymakers had to balance slowing growth against rising

inflation.

Blanchflower told the British newspaper that the greater

danger was to ignore the risk of a slowdown.

"I believe that there are risks to the upside to inflation

but the greater risks are to activity on the downside," he was

quoted as saying.

"Evidence from the housing market and especially the

commercial property market is worrying," he said.

Blanchflower said he was not surprised by last week's

emergency interest rate cut by the U.S. Federal Reserve as the

question for the U.S. economy was not whether there would be a

recession, but rather how long it would be.

He said this would have an impact on British growth and

jobs. "It is time for the MPC to lead not follow," he said.

(Reporting by Sumeet Desai, editing by David Clarke and Braden

Reddall)

2008年1月24日 星期四

[每日摘要]20080124

今天匯市相對平靜許多

當然股票市場還是波動

HSI上下刷5% 由+4%到-1%

主要還是對金融環境的不安心產生疑慮

最主要的消息是Societe Generalse 的新聞

某一個交易員作連結型商品的期貨竟然輸掉4.9Bln EUR,

相當2千億台幣,使得股市大跌,EUR/CHF 繼續下行

看來EUR/GBP也還有機會挑戰前高

不過這個也可能是單一事件,餘波不致於太大

2. 日本公布出口數據,不但是對美國出口放緩,對歐洲及中國成長率也是下滑,

Re-Couple又一個證據?

3. ECB's Liebscher : Inflation is the main focus in near term.

Euro zone growth could be below 2% this year.

4.IFO SAYS JAN GERMAN BUSINESS CLIMATE INDEX 103.4 VS REUTERS CONSENSUS 102.2

IFO'S RUSS SAYS ECB SHOULD WAIT UNTIL H2 2008 BEFORE THINKING ABOUT QUARTER POINT CUT

(Bloomberg) -- Societe Generale SA said it will seek 5.5 billion euros ($8.1 billion) in new capital after discovering a case of trading fraud and taking further writedowns linked to the U.S. subprime mortgage market crash. The bank discovered last weekend that a trader in Paris had secretly set up positions that will cost the company 4.9 billion euros before tax, Societe Generale said in an e-mailed statement today. The trader, who wasn't identified, went beyond permitted limits on futures linked to European stock indexes. Societe Generale will also take 2.05 billion euros in writedowns related to credit market turbulence. The bank said it will still make a profit of between 600 million euros and 800 million euros for 2007. An offer by Chairman Daniel Bouton to resign was rejected by the board, the bank said.

2008年1月23日 星期三

[每日摘要] 20080123

今天幾個重要訊息

1.Fed 在2008/01/22 緊急降息3碼到3.5%,等於承認經濟衰退已經是不可否認的事實,且需要更重的藥來服用。上一次緊急會議而降息是在01年911

2.BOE's King 也發表談話,摘重點如下

(1). 經濟展望今年面臨了挑戰

(2).房市及消費的衰退使得成長降低,今年必須面臨比預期還高的通膨及低成長的情勢

(3).因為通膨因素,BOE的降息循環將不如FED積極

言論中某些程度暗示了下一次的降息,下次BOE開會在2/7

3.股市回升,但台股仍疲。恆生爆走10.7%,大多數亞洲股市均回升,短期的情勢應趨於穩定

4.Market rumour talks ECB will cut 25bps before market open. 但事後只見Trichet 稍微評論了近期市場波動,並未討論到貨幣政策,對於Price expectation 仍是央行主要目標再度重申。

5.ECB Webber said should not overdramatise share moves

recession and stagflation ared not an issue in Germeny

=> 歐洲區這兒仍未鬆口,從昨天的財長言論到今天部份官員談話,都認為市場波動是一時,且美國的衰退和歐洲區不應作相對應的聯結。 (這點我個人是比較質疑的)

6.BOE minutes: 8-1 for hold , better than market expected

Housing market had weakened further , Xmas retail sales pattern seems softer but still unclear

Stg fall putting upward pressure on inflatio, markets pricing significant risk of further fall

Most MPC thought consecutive rate cuts would suggest policy focus on demand, ont inflation

Downside risk to growth had increasde but upside risk to inflation also up since Nov forecasts.

7.GE GDP (Q4) exp 0.5% QoQ Act 0.6%QoQ

King 的談話

http://business.timesonline.co.uk/tol/business/economics/article3234961.ece

摘重點

The Bank of England sounded a stark warning last night that the economy faced its most testing period for a decade and that the persistent danger of inflation left it boxed-in over potential action to stave off a severe downturn.

In a grim assessment of the conflicting economic pressures buffeting Britain, Mervyn King, the Bank’s Governor, said that the country could endure a “possibly quite sharp” slowdown this year as a weakening housing market and consumer spending continued to limit growth.

He gave warning that the Bank was hamstrung in its ability to counter the slowdown because soaring food and energy costs were putting pressure on inflation.

“To put it bluntly, this year we are probably facing a period of above-target inflation and a marked slowing in growth,” Mr King said. “You might think we have now entered a not-so-good period

........中略

However, his tough stance on inflationary risks dampened prospects for aggressive cuts this year and quashed hopes that the Bank might follow the dramatic cut in interest rates made by the US Federal Reserve.

Mr King said that inflation was being fuelled by the 10 per cent drop in the value of the pound since August, boosting import bills. “2008 is likely to see higher energy prices, higher food prices and, with a lower exchange rate, higher import prices, pushing inflation above 2 per cent,” he said.

This meant that the Bank faced “a difficult balancing act in the course of 2008”, but Mr King said that the big adjustments taking place in the economy and credit markets were necessary and “not a process that we should try to reverse "

2008年1月22日 星期二

[每日摘要] 殺聲震天 20080122

08年1月22日 會是個值得紀念一天

金融市場交易主軸都放股市

股市全面性重挫

TWII -6.51% N225 -5.65%

KS11 -4.43% HSI -8.65%

BSESN -7.97%

亞洲貨幣除日元外,也同步重挫 台幣盤中跌至32.500 最後在央行的干預外

勉強將貶幅控制在1角內,收32.439

韓圜兌美元也貶到兩年來新低

總而言之 "一片愁雲慘霧"...

現在再來回味一下年初寫下的文章....揮別2007 走向2008

經濟議題還是不脫離De-couple 及Re-couple上...

目前來看還是美國將大家拖下水的機率較大,

回顧之前幾次經濟事件..

亞洲金融危機 美國還是可以挺住

但是科技泡沫時 卻還是可以蔓延全球 來看,

美國感冒 全球打噴涕的老大哥情形還是會持續

這種情勢對美元是有利的,Usd-smile 的理論還是成立

只要美國經濟不佳,爛到極點 美元就有轉強的機會

但是回到市場瘋狂砍殺本身

還是屬於不理性行為,

不理性的砍殺不一定會馬上反彈,

有時候只是將市場的波動性再增加,

方向有時候還是正確的

這種由07年的"Greed" 轉向至08年的"Fear" 所引發的市場波動

正好是市場投資人及交易員需要去適應的

日本央行並未調整利率,BOJ總裁福井提到升息立場不變,

但是經濟成長較為疲弱的語調就頗令人意外,

但是日元今日還是除了美元外的最大贏家。

風險態度的修正,仍然幫助了 日元升值

反觀AUD/JPY EUR/JPY GBP/JPY 都大幅回落 甚至低於去年8月時的水準..

月底Fed開會的戲碼重要性越來越高

目前百分百預期降二碼 降三碼機率日益增加

以現在的市場渴望度來看,降三碼也無法救急

說不定還正好證實了衰退的事實.....

最近歐元區正好財長會議 面對如此市場動盪 來看看他們怎麼說

基本上他們還是對經濟前景蠻有信心,實在令人好奇的

但是歐元無可避免的還是有沉重的壓力...

EUROGROUP CHAIRMAN JEAN-CLAUDE JUNCKER

On possible reaction to turmoil:

"When financial markets act irrationally, and are driven by

herd behaviour, when stock markets demonstrate short-termism,

there is no reason for finance ministers to do the same."

"Europe and the euro zone are overall significantly better

positioned than our U.S. friends, our fundamental data are

better, the economic prospects are better."

Asked how big is the risk of a global finanncial collapse:

"I don't see the risk."

EUROPEAN MONETARY AFFAIRS COMMISSIONER JOAQUIN ALMUNIA

Asked if the world was heading for a recession:

"It's not about global recession, it's about a risk of a

U.S. recession, which has created this situation on the markets.

The question is how the U.S. will avoid recession. The U.S.

authorities are announcing some measures. The executive branch

has announced a fiscal stimulus. Fed President (Ben) Bernanke

has announced he will probably announce some decisions. I hope

they will be able to avoid recession and calm will return to the

markets."

DUTCH FINANCE MINISTER WOUTER BOS

Asked whether there is a risk of recession in Europe:

"No... our fundamentals are strong and unemployment is at

its lowest level."

SPANISH ECONOMY MINISTER PEDRO SOLBES

"Today it's important to see how Wall Street opens, to see

the reaction. It is true the situation is difficult, everyone is

concerned. But the U.S. and Europe are different, the starting

point of the economies in the U.S. and Europe is different.

"Europe and Spain are prepared to face this situation,

thanks to stability reached in budget terms."

FRENCH ECONOMY MINISTER CHRISTINE LAGARDE

"If growth should slow significantly in the euro zone, the

ECB would take it into account in its monetary policy, I

suppose.

"Our solid European fundamentals allow us to expect

significantly stronger growth in Europe compared to the likely

U.S. growth."

((Brussels newsroom +32 2 287 6841, fax +32 2 230 5573))

Keywords: ECOFIN/

2008年1月16日 星期三

[每日摘要]各國央行談話趨漸保守 20080116

昨天經濟數字是不好的

從UK RICS exp -45% Act -49% (1992 年以來新低)

GE ZEW exp 59 Act 56.5

到美國的零售數字 exp 0% Act -0.4%

Retail less Autos exp -0.1% Act -0.4%

通常因為汽車業的波動性很大 拿到汽車業的數字就比較重要...

最近風吹草動很多

而且金融環境又開始不穩定

連許多官員的談話都開始漸漸轉向

不過都是一些比較小的國家或是官員開始

要嚴格注意是否會引發整體美元弱勢的動盪

目前心態還是以偏空美元做操作,

但是不可太過貪心

22:44 15Jan08 RTRS-Bank of Italy-ECB worried on growth, not just CPI

ROME, Jan 15 (Reuters) - The European Central Bank is

worried about growth prospects, the Bank of Italy said on

Tuesday, adding that the euro zone growth outlook has worsened

sharply and may deteriorate faster than expected.

In its quarterly economic outlook the BOI gave a downbeat

assessment of euro zone and Italian growth prospects and said

world demand may slow this year, rather than rise slightly as

the ECB had forecast just one month ago.

At the ECB, "attention to inflation risks in a context of

increasingly sustained credit growth, is accompanied by worry

about the persistent uncertainties about the evolution of

financial tensions and the relative impact on the real economy,"

the Bank of Italy said.

It warned of a "concrete risk that credit conditions for

firms and families may undergo a significant tightening".

05:03 16Jan08 RTRS-UPDATE 1-SNB says market tensions ease but growth risks up

(Adds quotes, combines stories)

By Sven Egenter

FREIBURG, Germany, Jan 15 (Reuters) - Tensions in money

markets are easing but the markets are not back to normal yet

and the real economy is likely to be hit, Swiss National Bank

board member Thomas Jordan said on Tuesday.

Risks to growth in the Swiss economy as well as risks to

price stability have increased since the SNB last decided on

interest rates in December but the central bank still had no

monetary policy bias, Jordan said.

...中略

But the central banker warned against sounding the

all-clear signal yet. "We see a trend towards an easing of

tensions but the situation is not back to where it was in the

first half of 2007," Jordan said.

Central banks have offered ample liquidity since the crisis

broke in August as banks stopped lending to each other for fear

of being exposed to the problems in the U.S. subprime mortgage

market.

Jordan said the credit crisis was likely to spill over to

other parts of the economy.

"It would be naive to assume that a credit crisis of such a

size will pass without an impact," Jordan said.

While the U.S. economy was likely to suffer most, Europe

still looked robust -- though some damage was inevitable.

Growth in Switzerland was also likely to slow.

When the SNB kept its benchmark interest rate unchanged at

2.75 percent in December, the central bank pointed to the large

uncertainties from the credit crisis.

Jordan said that the risks for the Swiss economy had

increased since the bank's December meeting.

"We still think that we will have a robust development,"

Jordan said. "But the risks have increased again due to the

developments in the United States."

The SNB so far forecasts the growth rate to fall to

approximately 2 percent this year from some 2.5 percent in

2007. "The risks for our growth forecast have increased,"

Jordan said.

At the same time, the inflation outlook had deteriorated.

"Inflation risks have increased somewhat," Jordan said.

"Inflation will rise over our threshold of 2 percent as we have

forecast. But the development of commodity, oil and food prices

point to rather rising risks," he said.

Inflation has hit the highest in over 12 years with an

annual rate of 2 percent in December but the SNB said in

December it expected inflation to ease after peaking in the

first half of 2008.

"For monetary policy it is important that inflation starts

to ease once the economy starts to soften," Jordan said.

Stagflation -- the combination of persisting high inflation

and low growth -- was not part of the SNB's main scenario yet,

he said.

The recent rise in the Swiss franc helped to keep the

potential of imported inflation in check

"For us it was always important that the Swiss franc does

not weaken permanently against the euro," Jordan said.

"We don't see that danger at the moment. The franc has

risen from 1.68 per euro towards 1.61," he said.

Jordan said that the SNB had no reason to change its

monetary policy stance at the moment.

When asked if the SNB had a bias at the moment, Jordan

said: "As for today, no."

The SNB has described its monetary stance as a

"wait-and-see-mode" to gain time to assess the full impact of

the credit crisis.

(Editing by James Dalgleish)

2008年1月11日 星期五

[匯市簡評] 英歐利率不動,Fed主席發表保守言論 20080111

三大央行各有動作,昨天(2008 1/10)的確是市場人士緊張的一天。

Fed主席貝南克的演說中,很明確的指出08年的經濟成長的風險向下,

而且有進一步需要降息的空間(additional policy easing may be necessary,Fed is ready to take substantive additional action as needed to support growth)。

這些重點無疑的讓本次FOMC會議的降息預測由一碼移到兩碼,事實上,最近一直不斷的有Fed官員談話,結論也都是大同小異,但是貝南克是最保守的一個,層級又最高,自然更加讓市場側重。

不過經濟的問題及金融市場還是十分令人擔憂,今天的NY Times 批露了美林還打算打15Bln美元的壞帳 Giant Write-Down Is Seen for Merrill 及陸續的財報將公布,仍然是會讓美元及風險性資產承受些許壓力。

回到歐洲區,ECB最後選擇按兵不動,利率停在4%不變,高揚的通膨令ECB痛苦難耐(12月通膨 3.1% 高於 ECB 目標的 2%),但考量進經濟成長的趨緩下,不得不先以不變應萬變。

但是Trichet會後聲明卻仍然強調將用盡全力阻止Second round effect的通膨,這部份和之前他的同事們的談話也是一致,ECB官員近期談話。

之前有提到在美國急速衰退下,甚至於英國也開始衰退,這兩大貿易出口國都搖搖欲墜下,歐洲能否獨善其身呢?個人是十分好奇,在更多經濟數字出來後,歐元區可能會從是否升息轉移到是否降息的話題上。

一如2001年時,當時美國在降息,但ECB初期也是死ㄍ一ㄥ在那兒,但是後來還是放棄,經濟學人有提到這個事件請看Déjà vu (文中的插圖很有意思,當另外兩個人都下雨在撐傘時,歐洲人還不把傘撐開嗎?

英國就不用說了,從英鎊的走勢就看得出來,這次不降,下次降,早降早超生。

短線上美元應該還是弱勢,一但歐元區轉向,還是得小心逆轉。

柏南奇:聯準會將採具體行動促美經濟

顧經濟抗通膨 英韓歐元區利率不敢動

2008年1月10日 星期四

[經濟分析] ECB官員最近期的談話

感謝路透社的整理 ,這篇主要是留底用

ECB官員最近不斷強調Secone round effect,

通膨比成長趨緩還要令ECB恐懼

16:28 10Jan08 RTRS-FACTBOX-ECB policymakers' recent rate comments

Jan 10 (Reuters) - The European Central Bank is expected to

leave interest rates unchanged at 4.0 percent at its meeting on

Thursday.

Following is a summary of comments from members of the ECB's

Governing Council since the Dec. 6 meeting, when some members

urged a rate rise. To see full reports, double click on codes in

brackets. For President Jean-Claude Trichet's comments after the

last rate decision see [ID:nECBNEWS].

CHRISTIAN NOYER, GOVERNING COUNCIL, FRANCE, JAN 8

"Cross-border links between markets are closer than ever,

yet the current crisis is revealing the persistent nature of the

risks to financial stability." [ID:nPAB003720]

MARKO KRANJEC, GOVERNING COUNCIL, SLOVENIA, JAN 7

"The discussion was very serious, it was not empty talk,"

Kranjec said when asked about perceptions that the ECB was all

bark and no bite. "We have been very serious about acting as

needed ... but not neglecting developments in the real economy."

[ID:nL08522871]

NOUT WELLINK, GOVERNING COUNCIL, NETHERLANDS, JAN 7

"(The) most important point in Europe is that there will be

no second-round effects with respect to wages."

"I think that the monetary authorities made clear that they

will not accept such a development." [ID:nL07155637]

JEAN-CLAUDE TRICHET, PRESIDENT, JAN 7

"To sum up our analysis I would say: no complacency as

regards to inflation, and no complacency with regards to the

question of the significant correction in the markets," Trichet

said, summing up talks among G10 officials in Basel.

[ID:nL07100963]

LUCAS PAPADEMOS, VICE PRESIDENT, JAN 5

"It is essential to avoid any blurring of monetary policy

actions that pertain to the preservation of price stability, and

money market operations that have as an objective to ensure

orderly conditions in the money market." [ID:nN05348205]

JEAN-CLAUDE TRICHET, PRESIDENT, JAN 5

"The ECB's Governing Council stands ready to counter upside

risks to price stability."

"For the recent increase in inflation to remain temporary,

it is essential that the price- and wage-setting behaviour

remains unaffected by current inflation rates." [ID:nL05296686]

ATHANASIOS ORPHANIDES, GOVERNING COUNCIL, CYPRUS, JAN 3

"Just because the ECB Governing Council waited for the turn

of the year does not mean that it should not be ready to raise

interest rates further if that was necessary." [ID:nBEB001986]

AXEL WEBER, GOVERNING COUNCIL, GERMANY, DEC. 29

"The current, unusually high inflation rates in Germany and

the euro zone must not be the yardstick for the next wage

round," he wrote in a contribution to a newspaper. "A spike in

prices as a result of excess wage rises can endanger medium-term

price stability. We would act decisively against this."

[ID:nL29714638]

YVES MERSCH, GOVERNING COUNCIL, LUXEMBOURG, DEC. 28

"In the course of 2007, financial turbulence developed. The

crisis, started in the United States, has also affected the

European financial sector. Its extent and impact on the real

economy are still uncertain," he wrote in an opinion piece.

[ID:nL28595680]

JUERGEN STARK, EXECUTIVE BOARD, DEC. 28

"It's also clear that we won't hesitate to act before we get

to second-round effects," he told a German paper. [ID:nL28400317]

GUY QUADEN, GOVERNING COUNCIL, BELGIUM, DEC. 27

"The danger of a drying up of credit for the broader

economy, the infamous credit crunch that some referred to at the

start of the crisis, has not materialised. The financial

turbulence of recent months has thus far not had any serious

impact on the real economy, in any case in Europe."

[ID:nL27611794]

JUERGEN STARK, EXECUTIVE BOARD, DEC. 27

"Currently we expect that the rate of inflation will remain

above 2 percent for several months but we will then converge

back to the 2 percent level in the course of next year. However,

this is based on the assumption that we will avoid a wage-price

spiral where rising wages fuel into higher inflation rates."

[ID:nL27310841]

JEAN-CLAUDE TRICHET, PRESIDENT, DEC. 24

"What is decisive are the second round effects. There we

have the risk, and I was very clear that on behalf of the

Governing Council, we would not let those second round effects

materialise, and that we were alert to avoid those second round

effects materialising." [ID:nL24547830]

JEAN-CLAUDE TRICHET, PRESIDENT, DEC. 21

"It's our responsibility to make sure that this inflation is

just temporary and doesn't spill over into the cost of living,

and particularly that it doesn't affect wage negotiations."

[ID:nFAE002120]

VITOR CONSTANCIO, GOVERNING COUNCIL, DEC. 21

"I have shown some preoccupation regarding risks to growth

next year in the world economy ... in other words, I am a little

more pessimistic than a few months ago." [ID:nL21509225]

KLAUS LIEBSCHER, GOVERNING COUNCIL, DEC. 21

"The ECB will do everything that's necessary so that the

inflation rate (in the euro zone) falls below 2 percent again in

the medium term." [ID:nL21312293]

JEAN-CLAUDE TRICHET, PRESIDENT, DEC. 20

"We are alert and everybody must know that we will do

whatever is needed to deliver price stability in the medium term

and be credible in that delivery," he said. "The single needle

in our compass is price stability." [ID:nL19894820]

YVES MERSCH, GOVERNING COUNCIL (LUXEMBOURG), DEC. 18

"(We) do not underestimate the difficulty of explaining a

hump that is higher and more protracted than expected, and to

explain the difference between such a hump -- which would not

merit action -- and a plateau -- which might merit action," he

told news agency Market News.

"It might well last into summer before everything (on credit

markets) returns to normal ... but this is not a pre-requisite

for drawing policy conclusions." [ID:nL18146895]

JEAN-CLAUDE TRICHET, PRESIDENT, DEC. 19

"We are here to tell you we will not tolerate second round

effects," he told a European Parliament committee [ID:nL1956236]

KLAUS LIEBSCHER, GOVERNING COUNCIL (AUSTRIA), DEC. 19

"There was a remarkable loss of confidence in the

international financial markets emanating from problems with

subprime credits."

"We should assume that the problems are not over yet. The

insecurity will last for another few months and parts of the

insecurity will only be overcome once final annual balance

sheets have been published." [ID:nL18448839]

JUERGEN STARK, EXECUTIVE BOARD, DEC. 18

"At the beginning of the fourth quarter we recorded a

weakening in the confidence indices and first signs of a

possible economic slowdown," he said. "But these indicators are

still well above the long-term average." [ID:nL18406084]

NICHOLAS GARGANAS, GOVERNING COUNCIL (GREECE), DEC. 16

"Although inflation in the euro zone is expected to rise in

the next months, it is projected to ease during 2008. However,

inflation risks have increased and the ECB will do whatever is

necessary so that inflation expectations are stabilised at

levels in line with price stability." [ID:nL16613103]

KLAUS LIEBSCHER, GOVERNING COUNCIL (AUSTRIA), DEC. 14

"We have to take care that there is not too much liquidity

coming into the market," he told reporters. "In that regard,

there is a certain concern that the money market is not coming

down from 4.8 to 4.9 percent." [ID:nL1439181]

NOUT WELLINK, GOVERNING COUNCIL (NETHERLANDS), DEC. 14

"Until the end of January four financial injections are

provided for by central banks. If that does not appear to be

enough then we will have to consider things again," he told

Dutch daily De Telegraaf.

"Central banks must remain vigilant and inflation now of 3

percent in the eurozone makes us seriously concerned."

[ID:nL14628498]

2008年1月4日 星期五

[金融要聞]Bank warns on mortgage defaults 20080104

此篇新聞來自BBC網站 http://news.bbc.co.uk/2/hi/business/7169389.stm

The number of households defaulting on their mortgage payments is expected to rise over the next three months, the Bank of England has warned.

Its gloomy assessment comes as it says the global credit crunch is likely to worsen into 2008, as banks become less willing to lend out funds.

The Bank's comments came as it said homes and firms found it harder to borrow funds towards the end of 2007.

Its findings may raise hopes of a further cut in interest rates.

The Bank's comments came in its latest quarterly Credit Conditions Survey, which covers the last three months of 2007.

It said banks were now less willing to lend because of the higher cost and reduced availability of credit.

Growth warning

Both secured and unsecured household lending fell "due to lenders reducing their risk appetite", the Bank said.

![]()

![]() The credit crunch should push GDP growth to 2% or lower this year and next

The credit crunch should push GDP growth to 2% or lower this year and next ![]()

Vicky Redwood, UK economist at Capital Economics

It added that "recent financial market turbulence as well as expected changes in the cost and availability of funds, would point to lower credit supply".

The Bank last cut rates at the start of December, reducing them to 5.5% from 5.75%.

This was the Bank's first rate cut since August 2005, with its nine-member rate-setting Monetary Policy Committee (MPC) unanimous in their decision.

Vicky Redwood, UK economist at Capital Economics, said the findings of the survey indicated that both consumer spending and business investment were now likely to suffer, hitting the UK economy.

"Together with the delayed impact of previous rate hikes and the global slowdown, the credit crunch should push GDP growth to 2% or lower this year and next," she said.

Howard Archer, chief UK and European economist at Global Insight, said the Bank of England could now cut rates further as early as next week when the MPC meets for its January rate-setting decision.

"An undoubtedly weak survey, albeit expected," added George Buckley, chief UK economist at Deutsche Bank.

2008年1月1日 星期二

[匯市簡評]揮別2007 走向2008

2007年已經進入尾聲,07年對所有的金融交易者來說,都是極具挑戰性的一年。尤其是在前幾年相對平穩的環境下。

07年上半,農曆年後的第一次股災,就開始為今年的挑戰寫下序號,下半年的二次修正,更將股、債的投資人打下兩次深淵。所幸,在外匯市場上,無論你是Carry trade或是Non carry trade,只要是不要去持有美元,不但能全身而退,而且還可以含笑收割。

明年呢?最近各家投資銀行開始發佈明年的經濟水晶球,價位是絕對要忽視不看的,但是幾點共識倒是可以拿出來分享︰

1.經濟成長的減緩︰美國不用說了,歐洲最近幾個月出來的數字也漸漸走向持平。

2.通膨先上後下︰正如ECB官員不斷強調的Secone round effect,由石油、食物所引發的通膨外溢效應仍將發酵。但是較疲弱的成長速度將有效的降低通膨。至於是否會到停滯性通膨的地步,我個人是比較樂觀。

3.07下半年還有一個decouple和recouple的議題,這些EM亞洲及中國能否讓龍頭美國失去動能時,繼續帶動經濟成長?這問題還是見人見智,恐怕也是目前最分歧的一點。建議先別下定論,邊走邊看,EM亞洲可能較中國更值得憂慮。

4.回到金融市場本身,不確定性仍是08年的主軸之一,貨幣市場仍然是觀察重點之一,十二月下半旬起的聯合釋放資金行動,很明顯的讓貨幣市場走向穩定,但是央行總不能無限制挹注資金,金融市場的穩定還是得靠自已來解決,應該還有幾次呆帳打消,Libor rate的變化還是要注意

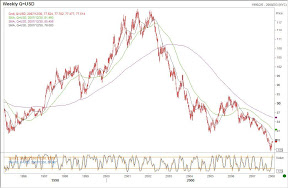

5.回到美元,從96年起的美元升值至2001,再到2007的一個大循環,時間長度大約一致,雖然不代表美元即將大幅回升,但再下挫空間有限。

短線上,美元仍將處於弱勢,那是阻力最小的一條路,尤其是狂歡回來後,發現手上部位空空時....

這是無名的最後一篇 也是Blogspot的第一篇

大家新年快樂,明年見